Analyzing rates of return on various assets is one of the most significant responsibilities in financial markets. We need past information for the asset to complete this analysis. There are several data suppliers, some of them are free while the majority are not. In this chapter, we will use data from Yahoo Finance.

ticker <- 'AMT'

start_from <- "2016-01-01"

end_to <- Sys.Date()

# download stock data from yahoo finance

stk_data <- tq_get(x=ticker, get="stock.prices", from=start_from, to=end_to)

# tidyquant mutate function options

tq_mutate_fun_options()

# calculate daily returns

stk_data_daily_returns <- stk_data %>%

tq_transmute(select = adjusted,

mutate_fun = periodReturn,

period = "daily")

# plot daily returns

p1 <- stk_data_daily_returns %>%

ggplot(aes(x=date,y=returns))+

geom_line()+

geom_hline(yintercept = 0) +

ggtitle("Daily Returns")+

labs(x="Date",y="Returns")+

scale_x_date(date_breaks = 'years',date_labels = '%Y-%b') +

scale_y_continuous(breaks = seq(-0.5,0.5,0.05),labels = scales::percent)+

theme_tq()

# calculate cumulative returns

stk_data_cum_returns <- stk_data %>%

tq_transmute(select = adjusted,

mutate_fun = periodReturn,

period = "daily") %>%

mutate(cumret = cumprod(1 + daily.returns),

cumulative_returns = cumret - 1) %>%

select(-cumret)

# plot cumulative returns

stk_data_cum_returns %>%

ggplot(aes(x = date, y = cumulative_returns)) +

geom_line() +

theme_tq() +

labs(x = "Date", y = "Cumulative Returns") +

ggtitle("Cumulative returns")

# put them into functions

download_stock_data <- function(ticker,start_from,end_to) {

stk_data <- tq_get(x=ticker, get="stock.prices", from=start_from, to=end_to)

return(stk_data)

}

cum_returns_plot <- function(df,period="daily",cum_plot=T) {

cum_returns_df <- df %>%

tq_transmute(select = adjusted,

mutate_fun = periodReturn,

period = period,

col_rename = "returns") %>%

mutate(cumret = cumprod(1 + returns),

cumulative_returns = cumret - 1) %>%

select(-cumret)

if(cum_plot==TRUE) {

p <- cum_returns_df %>%

ggplot(aes(x = date, y = cumulative_returns)) +

geom_line() +

theme_tq() +

labs(x = "Date", y = "Cumulative Returns") +

ggtitle("Cumulative returns") +

scale_x_date(date_breaks = 'years',date_labels = '%Y-%b')

} else {

p <- cum_returns_df %>%

ggplot(aes(x=date,y=returns))+

geom_line()+

geom_hline(yintercept = 0) +

ggtitle(paste0(ticker," ",period," returns"))+

labs(x="Date",y="Returns")+

scale_x_date(date_breaks = 'years',date_labels = '%Y-%b') +

scale_y_continuous(breaks = seq(-0.5,0.5,0.05),labels = scales::percent)+

theme_tq()

}

return(p)

}

# let's test the functions

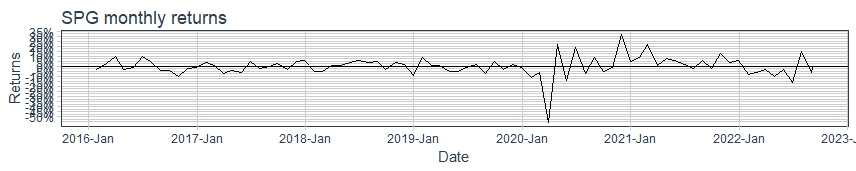

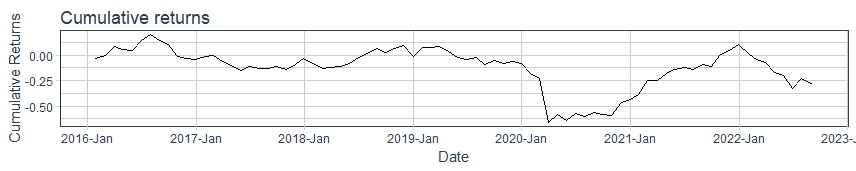

ticker <- 'SPG'

start_from <- "2016-01-01"

end_to <- Sys.Date()

df <- download_stock_data(ticker,start_from,end_to)

cum_returns_plot(df,period="monthly",cum_plot = T)

by

by